Looking to build a mortgage calculator for your website? In this tutorial, we will guide you through the process of creating a simple mortgage calculator using simple HTML.

But first, let us explore a few ideas how your website can benefit from a calculator widget and how you can turn it into a lead capture form.

Using the mortgage calculator on your website can significantly improve user engagement, lead capture, and overall business performance. Here are some ideas to leverage the mortgage calculator for better results:

Landing Page:

Create a dedicated landing page featuring the mortgage calculator to attract potential clients looking for mortgage information. Optimize the page for SEO and use targeted keywords to drive organic traffic.

Call-to-Action (CTA)

Place a clear and compelling CTA (e.g., “Get a personalized mortgage quote” or “Schedule a consultation”) right below the mortgage calculator. This encourages users to take the next step after using the calculator.

Lead Capture Form

Add a simple form that users can fill out to receive personalized mortgage quotes or additional information. Collect basic contact information like name, email, and phone number for follow-up.

Interactive Comparison

Enhance the mortgage calculator by allowing users to compare different loan scenarios side-by-side (e.g., different interest rates, loan terms, or down payments). This can help users understand the impact of various factors on their mortgage payments, increasing engagement.

Integration with CRM

Integrate the lead capture form with your CRM system to automate follow-up and keep track of leads. This helps you nurture leads and convert them into clients more effectively.

Educational Content

Provide helpful articles, infographics, or videos related to mortgages, home buying, and the real estate market alongside the calculator. This can help establish your website as a valuable resource, increasing trust and credibility.

Retargeting Ads

Utilize retargeting ads to re-engage users who interacted with your mortgage calculator but did not convert. These ads can remind users of your services and encourage them to return to your website for further assistance.

Email Marketing

Use the captured email addresses to send out targeted email campaigns with relevant mortgage tips, updates, and offers. This can keep your brand top of mind and potentially convert leads into clients.

Social Sharing

Encourage users to share the mortgage calculator with their friends and family on social media. This can help increase your brand’s visibility and reach a broader audience.

Test and Optimize

Continuously track and analyze user behavior, conversion rates, and overall performance. Use this data to make improvements to the mortgage calculator, lead capture form, and other website elements to optimize user experience and lead generation.

Implementing these strategies can help you effectively use the mortgage calculator on your website to generate leads, engage users, and ultimately boost your business.

The Math behind

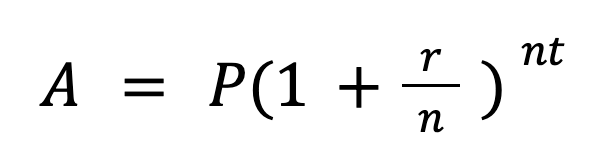

Compound interest is the interest calculated on the initial principal amount as well as the accumulated interest from previous periods. The formula to calculate compound interest is:

where: A = the amount after the specified time period P = the principal amount (the initial amount of money) r = the annual interest rate (as a decimal) n = the number of times the interest is compounded per year t = the time period in years

To calculate compound interest, follow these steps:

- Determine the principal amount (P).

- Determine the annual interest rate (r) and the number of times the interest is compounded per year (n).

- Determine the time period (t) in years.

- Plug in the values into the formula above

A = P(1 + r/n)^(nt). - Solve the equation to find the amount (A).

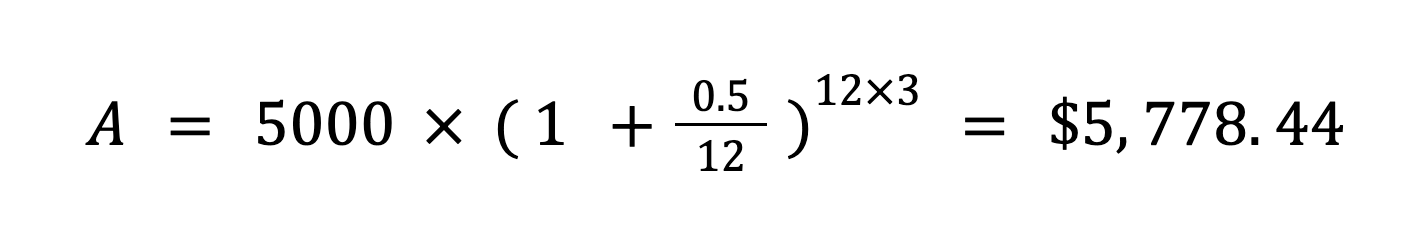

For example, let’s say you invest $5,000 at an annual interest rate of 5% compounded monthly for 3 years. Using the formula above:

P = $5,000 r = 5% = 0.05 n = 12 (monthly compounding) t = 3 years

Now let us move on to coding the mortgage calculation widget.

Step 1: Create the HTML Form

The first step is to create an HTML form that will collect user input for the loan amount, interest rate, and loan term. To create the form, you will need to use a combination of HTML form elements such as input, label, and button. Here is an example HTML code for the mortgage calculator form:

<div >

<form>

<div class="mb-3">

<label for="amount" class="form-label">Amount:</label>

<input class="form-control" type="number" id="amount" name="amount" required>

</div>

<div class="mb-3">

<label for="rate" class="form-label">Rate:</label>

<input class="form-control" type="number" value="12" id="rate" name="rate" required>

</div>

<div class="mb-3">

<label for="term" class="form-label">Term:(years)</label>

<input class="form-control" type="number" value="5" id="term" name="term" required>

</div>

<div>

Monthly Payment: <span r-calc="calculateLoanMonthlyPayment" r-format="currency|usd"> </span>

</div>

</form>

</div>

Note that we have included three input fields: Loan Amount, Interest Rate, and Loan Term. We have also included an empty span element with an id of monthly-payment, which will be used to display the calculated monthly payment.

Here is the Javascript code to calculate the monthly payment:

function calculateLoanMonthlyPayment({amount, rate, term}) {

let interestRate = rate / 100 / 12;

let loanTerm = term * 12;

let monthlyPayment = (amount * interestRate * Math.pow(1 + interestRate, loanTerm)) / (Math.pow(1 + interestRate, loanTerm) - 1);

return monthlyPayment;

}

We’re using a free, open-source library called NittiJS to do our calculations. This library is small and works by taking input from a form.

We have associated the calculation function to the span element using the r-calc attribute.

Note that there’s no “calculate” button required for this form. As you type or update the input values, the calculation is automatically run.

NittiJS is a great tool for building forms like this one. You can learn more about how to use it by reading the documentation found at this link: NittiJS.

Here is a live demo

You can try tingering with the code

See the Pen Loan calculation form (Using NittiJS) by Prasanth (@prasanthmj) on CodePen.

See Also

- Crafting a Loan Calculation Form with HTML for lead capture: Step-by-Step Guide, Free Sample Code, and Live Demo

- How to create a useful calculator widget in plain HTML quickly: sample code and live demo

- BMR (Basal Metabolic Rate) calculation HTML sample code - simple calculation widget HTML code with live demo

- Implementing an Interactive BMI Calculator Using HTML Code for Your Website

- Simplest method - Age Calculator Code for Your website